Trusted by leading companies across the globe

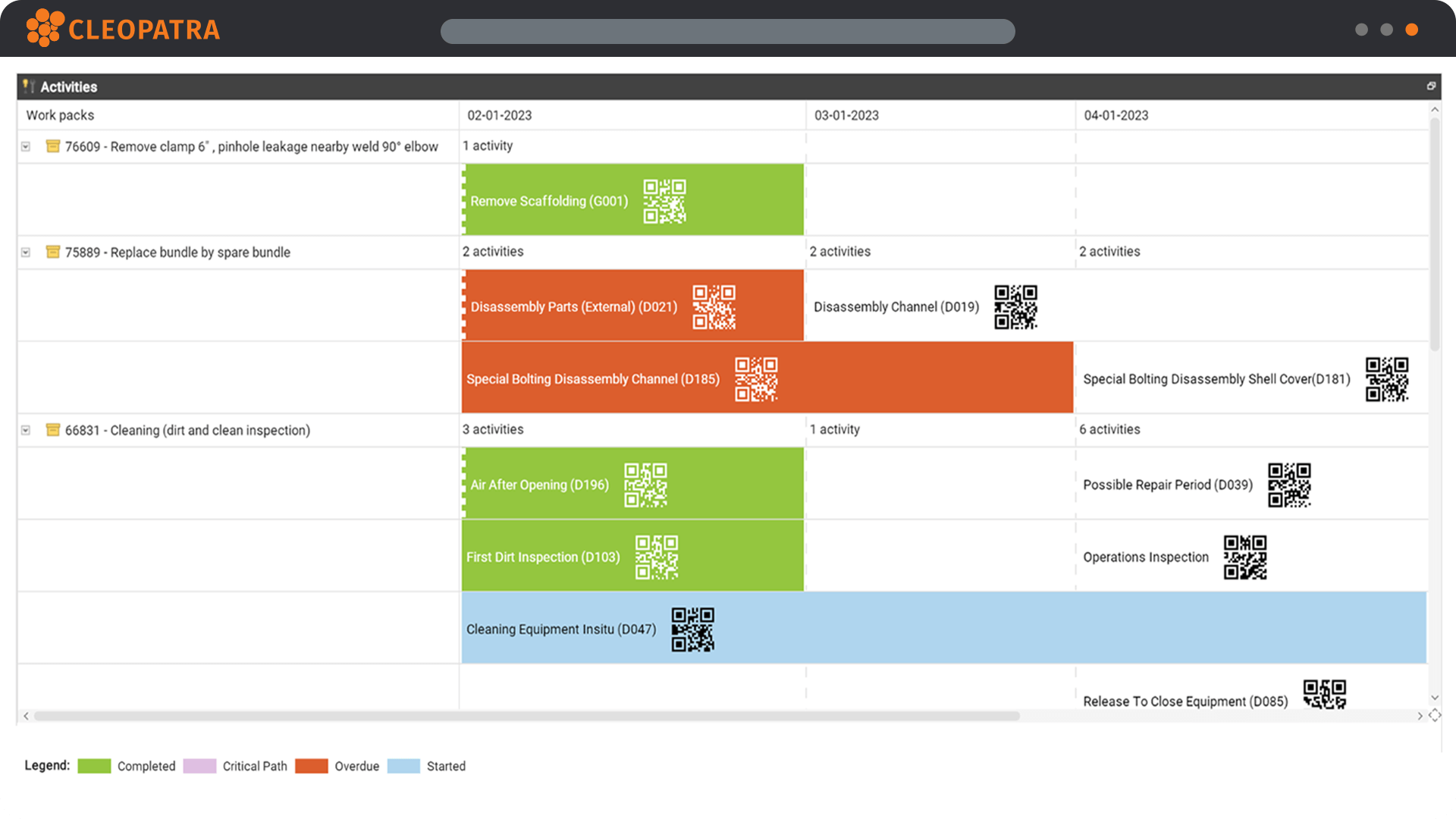

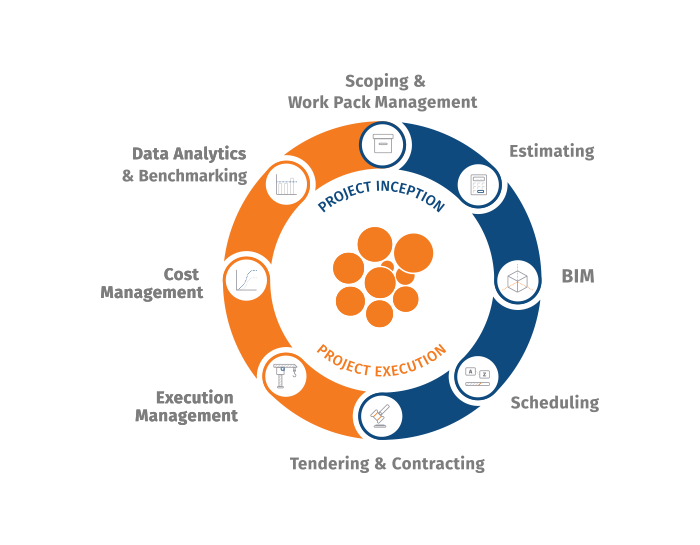

Integrated solutions covering the full project lifecycle

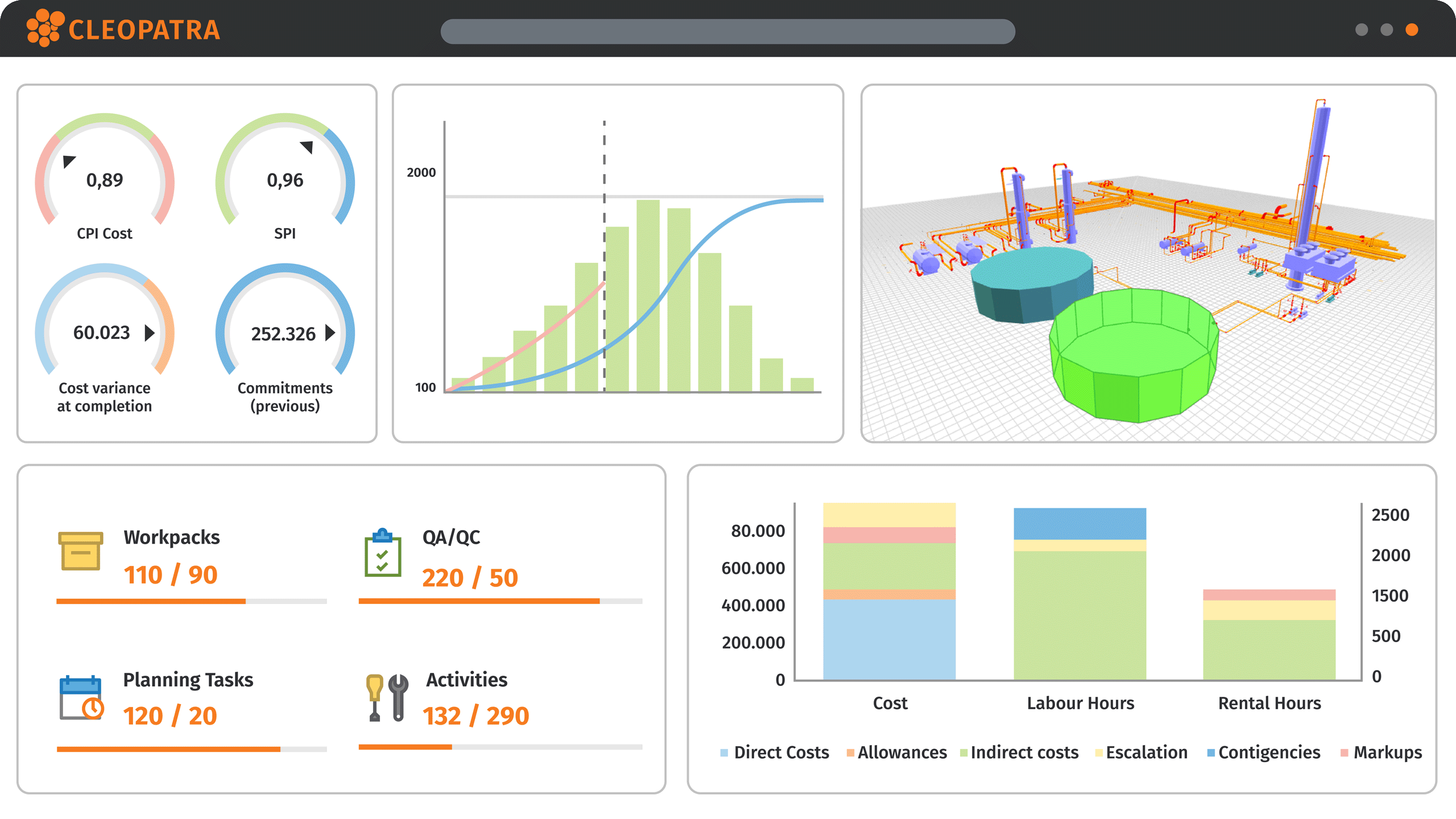

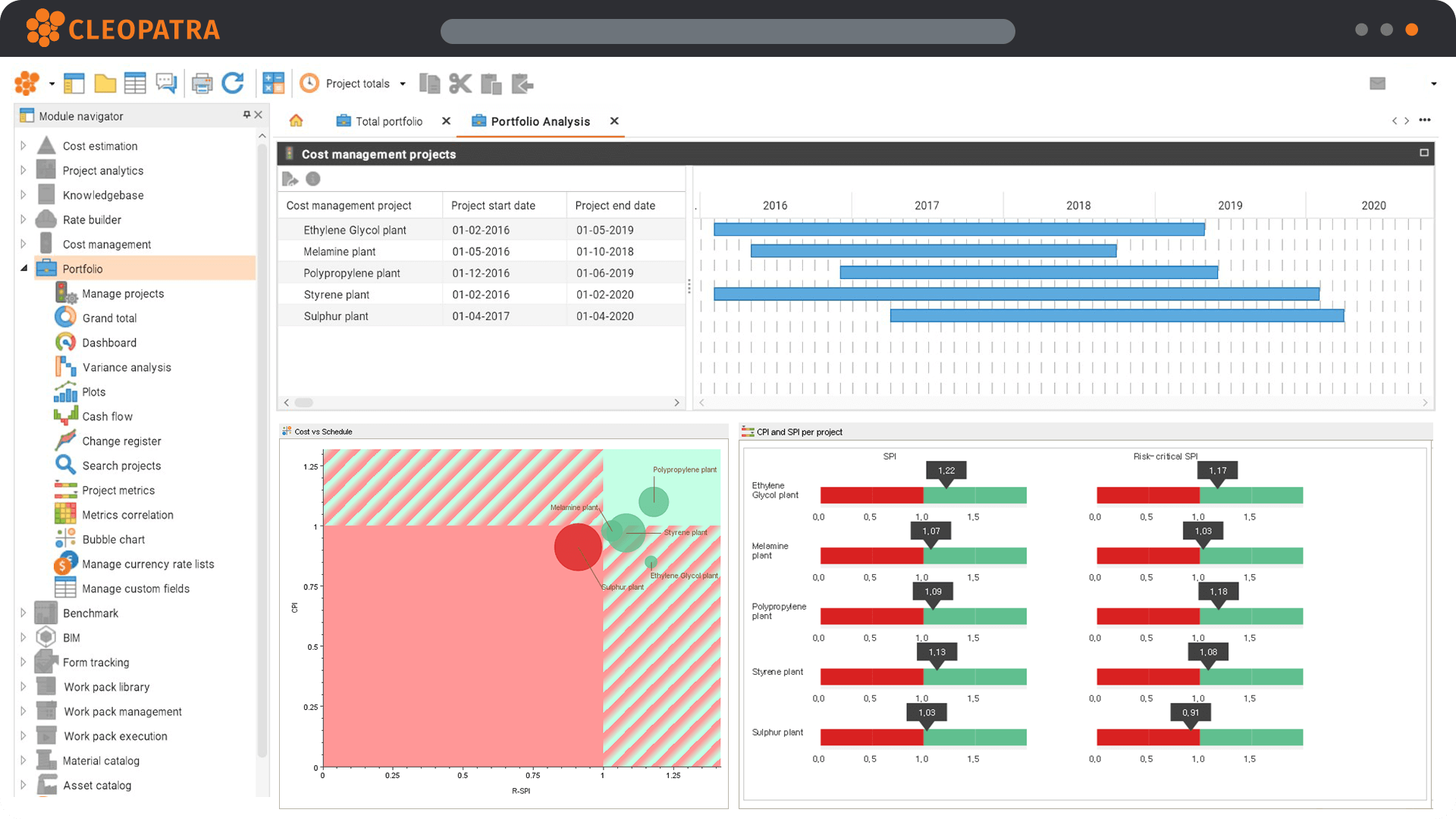

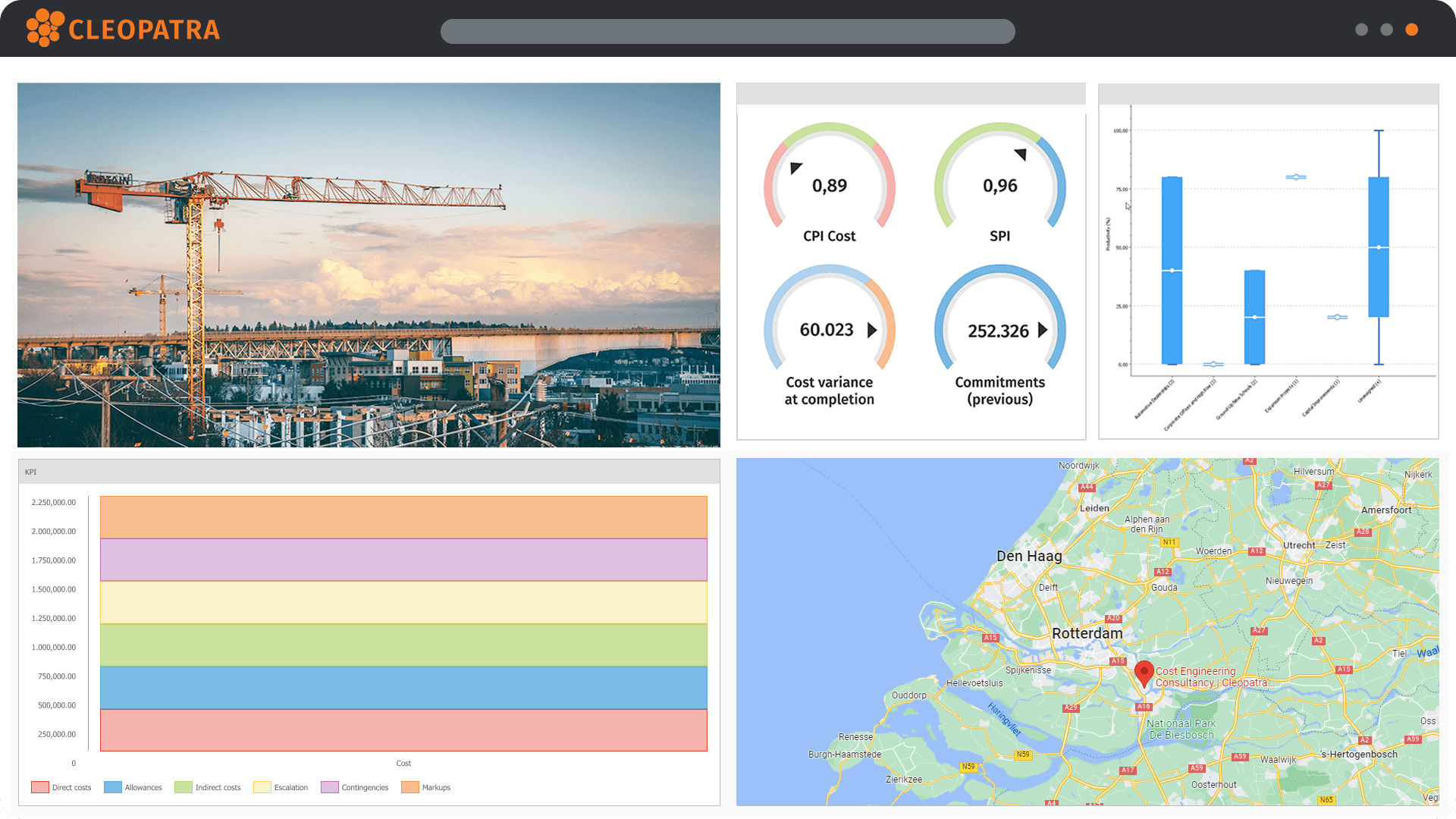

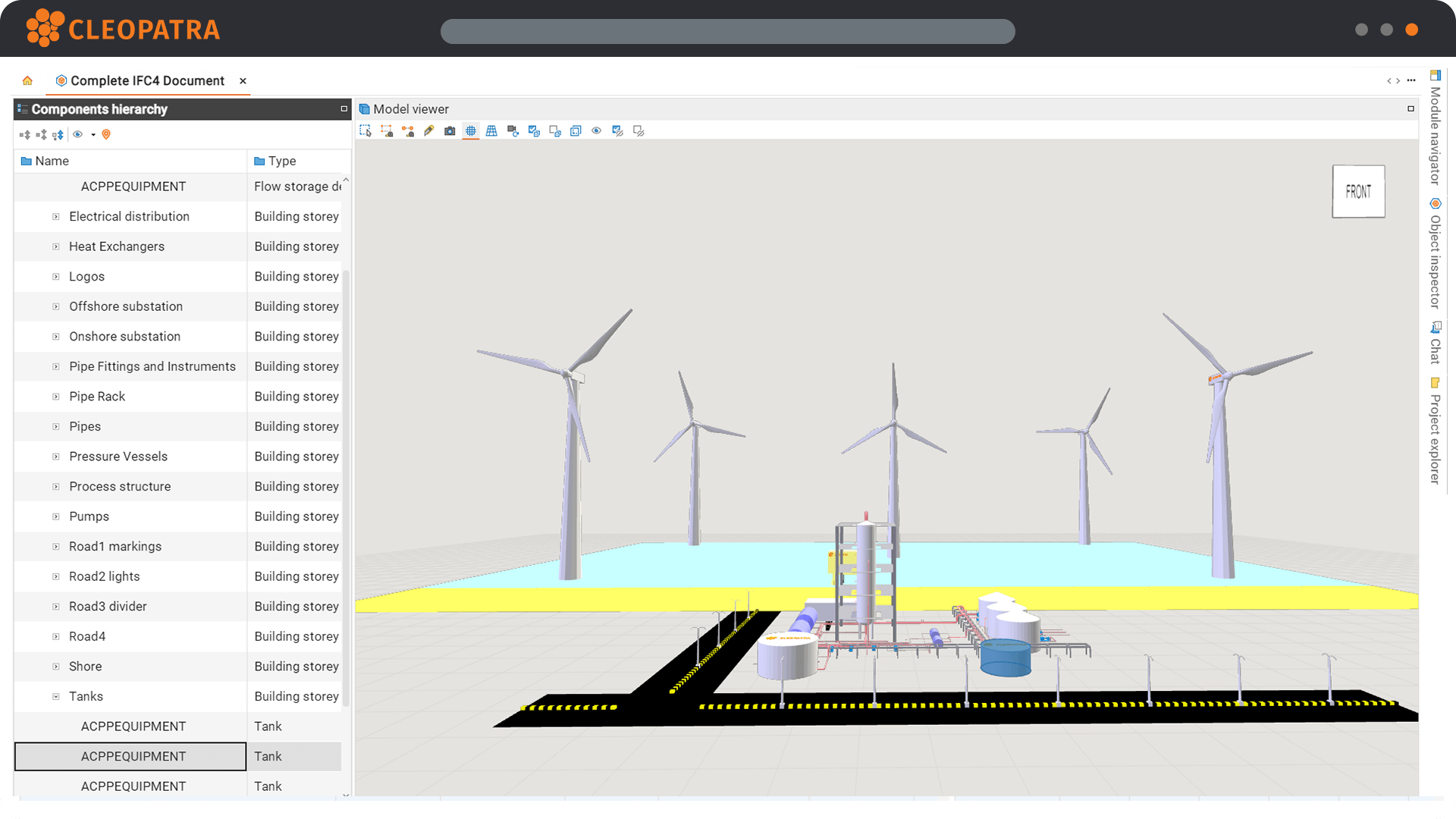

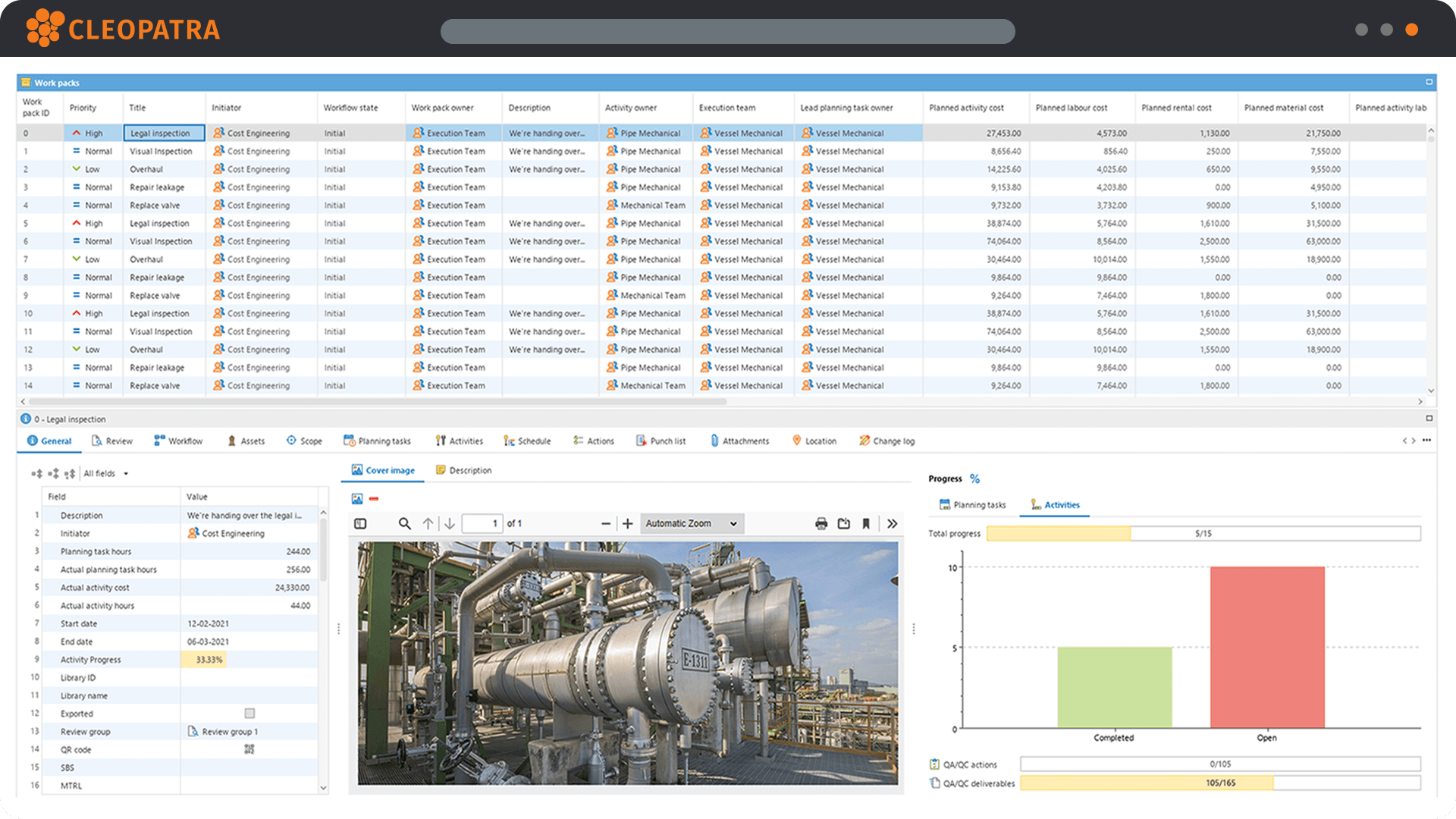

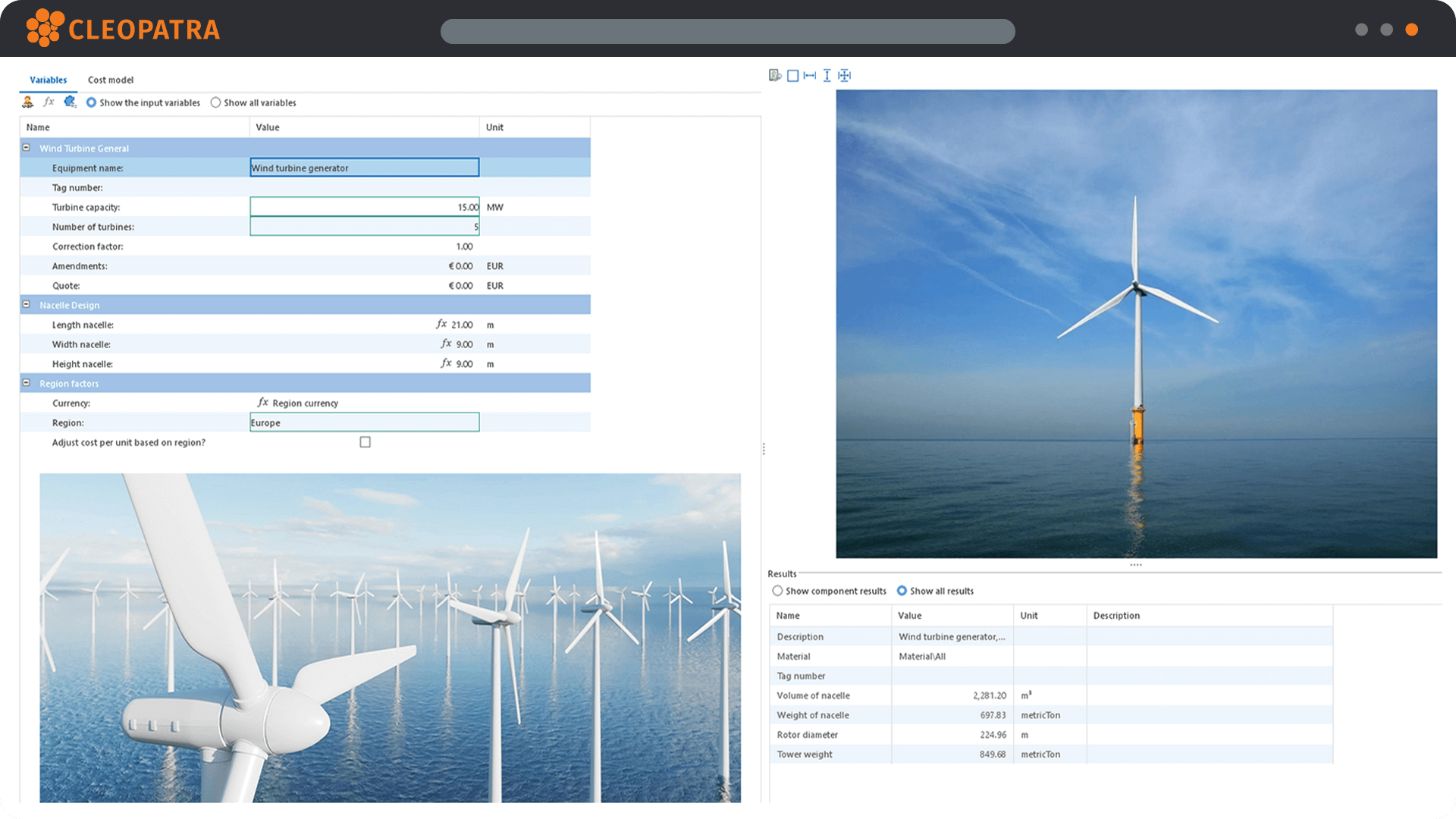

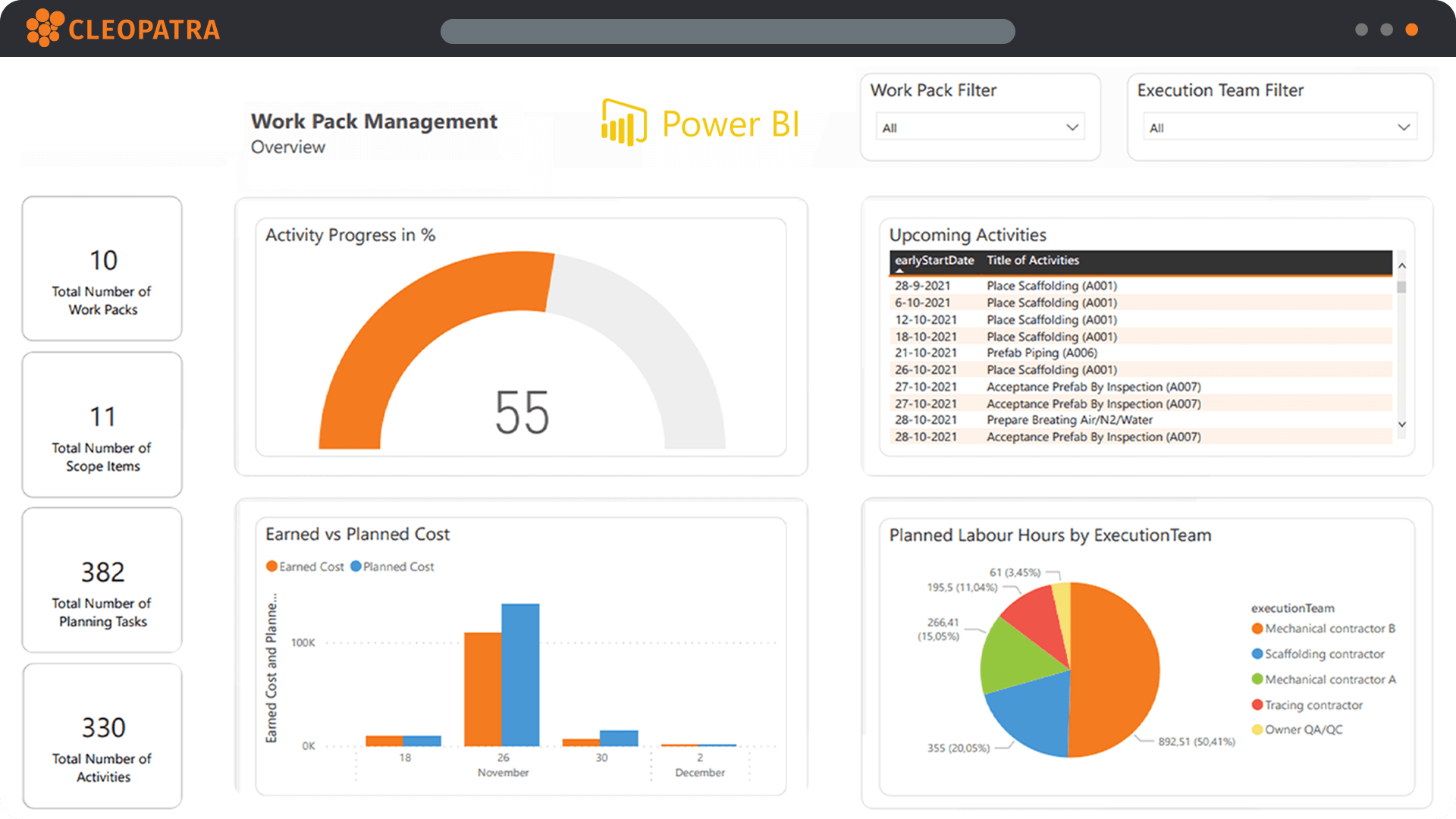

Cleopatra covers the entire project life cycle by including functionalities for different project controls disciplines in one advanced system.

With centralized data at its heart, Cleopatra ensures continuous improvement of project performance, and successful digital transformation.

What we can do for your industry

Designed to support owners, EPC contractors and engineering firms worldwide, Cleopatra accommodates the specific needs and requirements of demanding projects in several industries.

Fully integrated platform

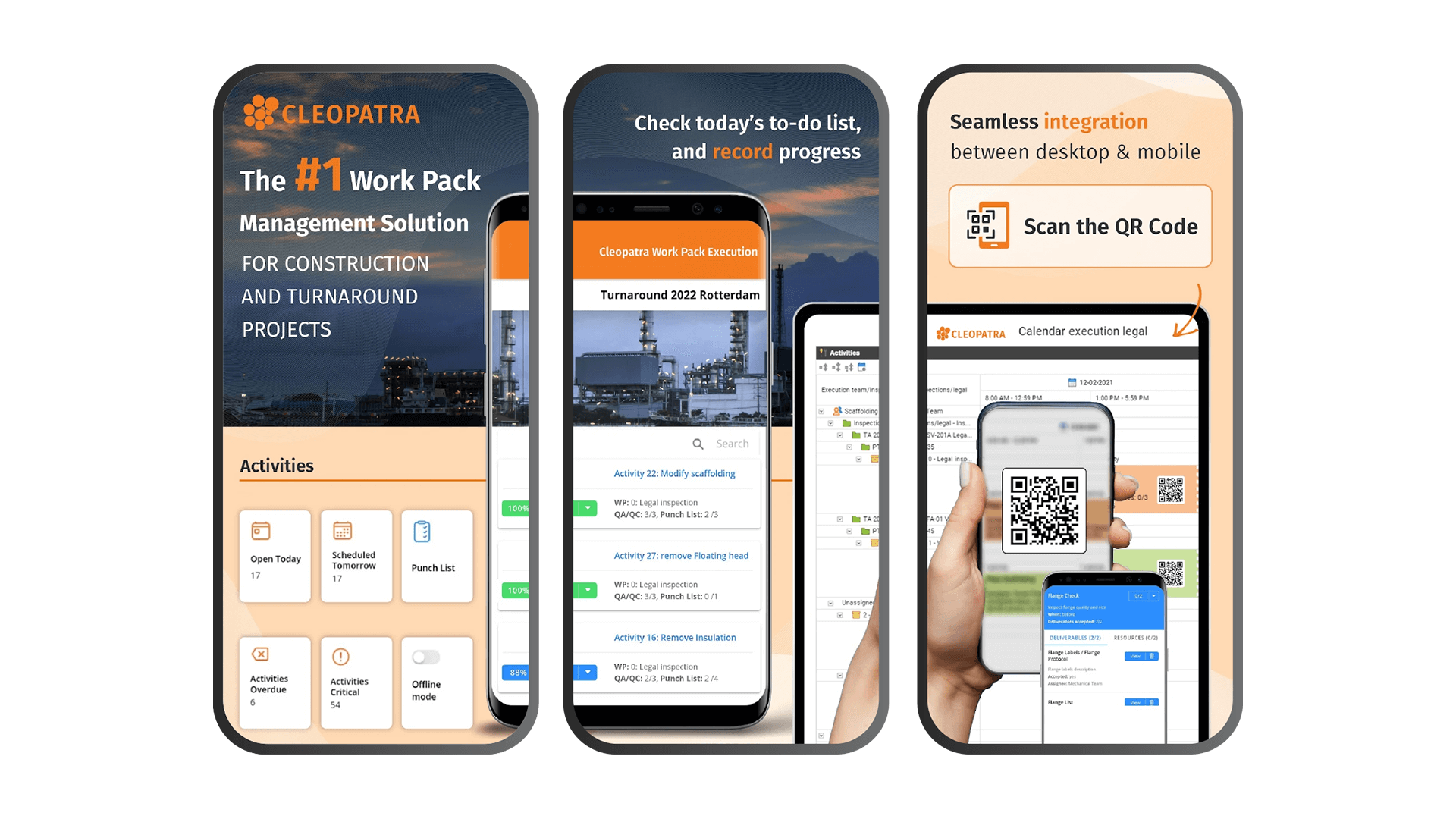

Covers the entire project lifecycle. Smart integration with 3rd party tools.

The innovative SaaS solution

ISO 27001 certified state-of-the-art technology.

25+ years of experience

Digital technologies combined with deep industry expertise.

What our customers are saying

Resources to improve project performance

Ready to start?

Request a live demonstration and experience the benefits Cleopatra Enterprise can have for your organization.